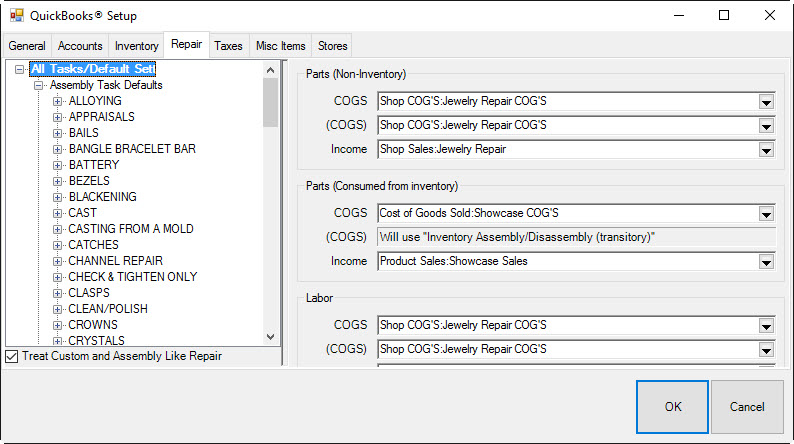

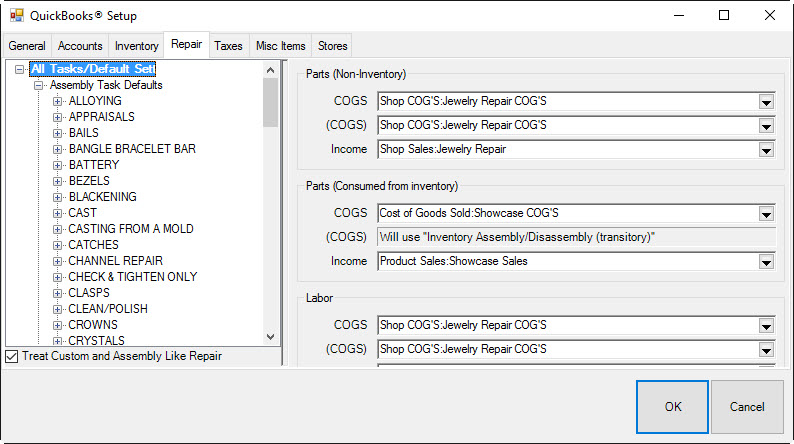

The Repair tab controls how repair, custom, and assembled items are posted to QuickBooks.

The tree view on the left represents all repair SKUs on file, organized by their search keys. As in the inventory tab, the topmost item of the tree will be the default for all repair tasks, regardless of whether the tasks have an SKU at all. You need not specify anything at all for items other than the top item, unless you want to record expenses or income differently for that branch of the SKU tree.

The panel on the right allows you to specify the QuickBooks accounts where The Edge will post the corresponding income and expenses. For repair and custom jobs, this posting occurs only if and when a job is picked up at point of sale, with one exception: “Parts (Consumed from inventory)” the cost of service parts consumed from inventory are held in the account linked to inventory assembly/disassembly until time of pickup.

Notice the checkbox Treat Custom and Assembly Like Repair (default). Uncheck this box to provide separate mapping accounts for:

•Repair

•Custom

•Assembly.

Fields in the Repair tab include:

|

Parts (non-inventory) | ||||||||

|

|

COGS |

The cost of any parts used in the completion of a repair or custom job is posted to this account. These are parts that are not part of The Edge inventory records. | ||||||

|

|

(COGS) |

The cost of any parts used in the completion a repair or custom job is deducted from this account. These are parts that are not part of The Edge inventory records. Often it is preferred to specify the same account for COGS and (COGS) which would result in posting with no net effect. This is typically best because these parts have never been inventoried in The Edge and cost has likely been accounted for in QuickBooks already. | ||||||

|

|

Income |

The price paid by your customer for any parts used in a repair will be posted to this income account.

| ||||||

|

Parts (consumed from inventory) |

|

| ||||||

|

|

COGS |

The cost of any parts (from inventory) used in the completion of a repair of custom job is posted here. These are parts that are actually part of you inventory in The Edge.

| ||||||

|

|

(COGS) |

This feature is automatically linked to the GL Account you have associated with the asset feature Inventory Assembly/Disassembly (see the Accounts tab). The cost of the inventory item is credited from its inventory asset account and posts as a debit to this account.

At time of pickup, this account is credited by the amount of the inventory parts cost and posted as a debit to the actual COGS account assigned above.

| ||||||

|

|

Income |

The price paid by your customer for any inventory parts (actual inventory items in The Edge) used in a repair or customer job are posted to this account.

| ||||||

|

Labor | ||||||||

|

|

COGS |

The cost of any labor used in the completion of a repair or custom job is posted to this account. | ||||||

|

|

(COGS) |

The cost of any labor used in the completion of a repair or custom job is deducted from this account. If you track labor as a payroll expense, you should specify the same account for COGS and (COGS) and there will be no net effect. Alternatively, when specifying this account, you should consider how you pay for this labor. If your bench jeweler is on a fixed salary, you might want to deduct this amount from “payroll expenses.” If repairs of this type are always sent out, you might want to deduct this amount from an “outside services” account. | ||||||

|

|

Income |

The price paid by your customer for any labor used in a repair will be posted to this income account.

| ||||||

|

Other |

|

| ||||||

|

|

Other costs on a service job or task typically include shipping fees or insurance. | |||||||

|

|

COGS |

The cost of any “other” charges associated with the completion of the repair is posted to this account. This upcharge typically corresponds to the risk or liability of breakage. | ||||||

|

|

(COGS) |

The cost of any other fees incurred in the completion of the repair is deducted from this account. If you track other charges some other way in QuickBooks, you should specify the same account for COGS and (COGS) and there will be no net effect. Alternatively, if you pay for outside insurance to cover your liability in this area, you might want to specify an insurance expense account here.

| ||||||

|

|

Income |

The price paid by your customer for any other charges will be posted to this income account.

| ||||||