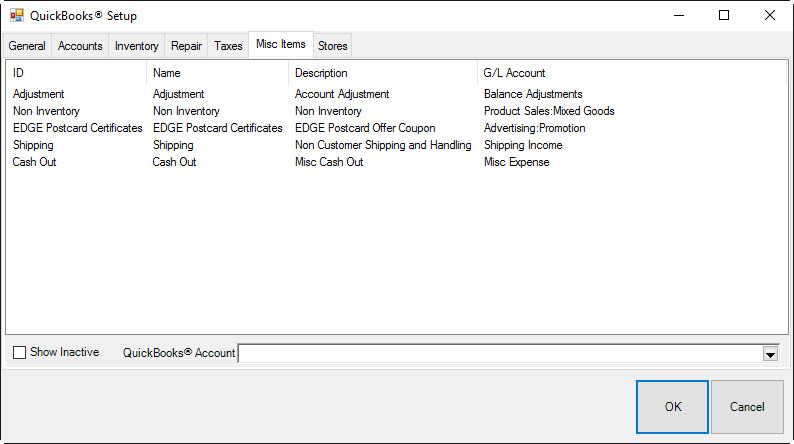

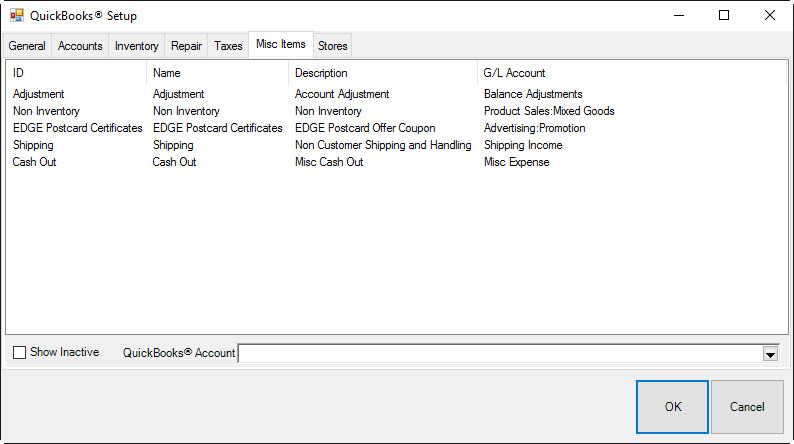

The Misc Items tab is used to associate each of your miscellaneous sales line definitions to a QuickBooks account. Whenever you sell via a miscellaneous sale line, the amount is posted to the corresponding G/L account, and an offsetting amount is posted to accounts receivable. Any tender is then in turn posted against the accounts receivable.

To associate an account:

1. Select the desired miscellaneous category.

2. Select an account from the QuickBooks Account drop-down list.

3. Select OK.

|

|

Unlike other features in The Edge, we cannot control what Misc Sale lines are used for in daily operations. You may have some Misc lines setup as Credits (such as coupons or donations) that should be mapped to expense-type accounts. Misc sale lines should typically be mapped to either an Income or Expense account. If you are not sure, you should consult your accountant. |

|

|

Check the Inactive Box to map any Misc Charges that have been used in the past. |