The Donate Item feature in The Edge allows you to donate items and track the activity. To donate an item:

1. Conduct a sale from the Point of Sale window as usual.

2. Create sale item lines as usual using Sell Item.

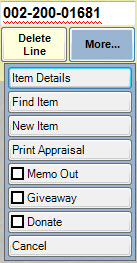

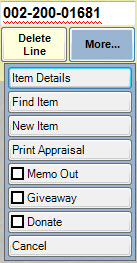

3. To indicate an item is to be donated, in the line item, select More….

4. From the More… sub-menu, select Donate.

5. The sale line item will indicate a price of zero.

6. Continue the transaction as usual.

|

|

•The customer must have a designation as being a tax-exempt entity, and there must be a tax ID number on record. To designate a customer as tax exempt, find the customer record, and in the Options tab, check the Tax Exempt option. This cannot be overridden. •Donated items can only be transacted alone or with other items to be donated. •Donations may only be returned by the person to whom they were donated. |

|

|

•For those using integrated accounting with QuickBooks, assign the Donation feature to an appropriate expense account with the guidance of your accountant. Accounts are changed in Administrative ►QuickBooks ► Setup QuickBooks Integration ►Accounts. •A donation may facilitate the need for a gift receipt. The gift receipt list selector does show “donation” in the beginning of the description in case you wish to exclude it. •New item status, donation, can be included or excluded on any inventory or filter using the letter code N. •To see a report of donation activity, go to Reports ► Inventory ► Donations. |